What is Risk Mitigation & Management

To ensure the endurance of your family’s wealth and security, we must ensure that your asset and risk management decisions are made with the complete understanding of, what you value and what you have at risk, and then how those risks can best be mitigated and managed.

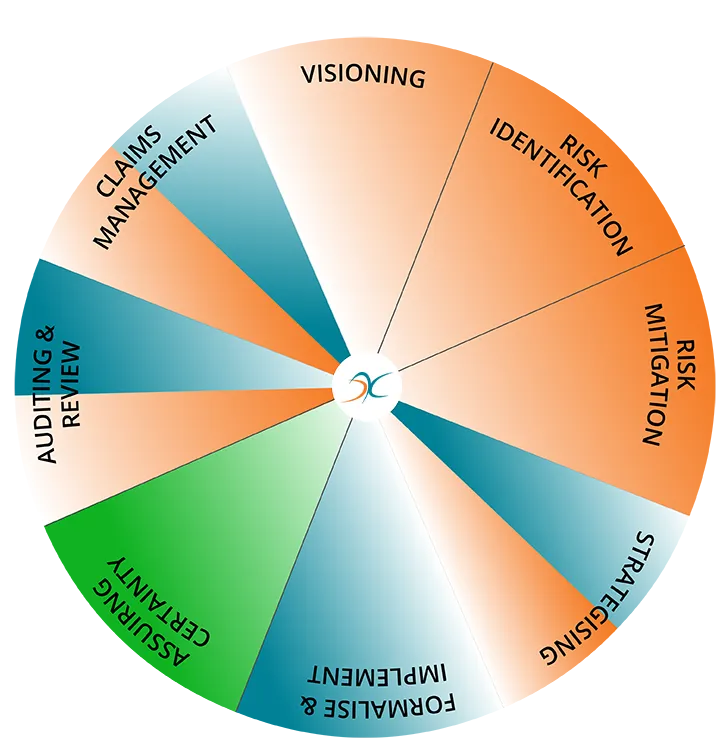

THE DKFS SYSTEM

RISK IDENTIFICATION

The symmetry of the fact-find questioning, client needs and objectives and cash flow analysis = Risk discovery process. The diagnostic tool is specific to the organisation i.e. Family, Incorporated and SMSF.

Via the diagnostic process individual risks are identified particular to the specific organisation.

ASSURANCE & CERTAINTY

Introducing you to our trusted panel of specialists regarding the construction of wills, buy/sell agreements, shareholders ‘buyout’ and other business / personal needs to provide you of certainty.

CLAIMS MANAGEMENT

Claims management service in documented deliverables and value proposition.

RISK MITIGATION

The academic basis by which each individual risk is priced providing the client with an objective financial exposure amount for each identified risk and the organisation as a whole.

Development of the risk management strategy. The strategy must provide a mitigation for each risk identified. this is achieved via a process of risk transference and risk retention resulting in production and delivery of the ‘Risk’ Strategy Document.

Creation of the SOA reaffirmation of the retention strategy and implementation of the transfer strategy and product placement.

AUDITING & REVIEW

Recreating the first four steps of this process. Identifying any surplus amounts which can be offset against any retained risks. Recreate and deliver the updated ‘Risk Strategy Document.

© 2025 DKFS - All Rights Reserved. Partnering with you on your financial journey with expert advice and tailored solutions.

0438 429 232